saifu

What's is saifu

Saifu is a licensed, crypto-fiat financial institution powered by blockchain technology and world-class bank-grade security technologies that allows private and corporate clients to easily buy, safely store, exchange and pay with crypto and fiat currencies using debit cards and IBAN accounts.

The Saifu interface is designed to be intuitive and similar in appearance and usability to traditional online banking services. The interface clearly shows different accounts for at and cryptocurrencies, and how much is in each account. Customers can also see prices for exchange rates between currencies.

The growth of cryptocurrencies is changing the way that people store and exchange value, but right now, cryptocurrencies are only accessible to a relatively small community. For most people, cryptocurrencies can be dif cult to buy, hard to keep safe and it’s dif cult to use them for many day-to-day financial transactions. Businesses are also considering how they can bene t from using cryptocurrencies, but many feel locked out of these new currencies. Poor integration between cryptocurrencies and traditional financial systems means that buying and using cryptocurrencies is often regarded as only being viable for ‘geeks’ and technology enthusiasts.

Saifu’s business model is reliant upon attracting individual and corporate clients. We expect business clients to make up the largest part of revenues, as overall transaction sizes should be much larger than those for individual clients. We expect individual clients will join Saifu in high volumes and make many smaller transactions at slightly higher rates.

Transaction rates are competitive for all customer transactions. Saifu revenue forecasts are largely based on the exchange operations, which should be competitive for customers because Saifu can achieve the best rates from the major exchanges that Saifu has accounts with. Saifu intends to be set up on eight exchanges for early operations, as well as establishing trading lines with major OTC market makers and liquidity providers. Agreements have been reached with some, while others are in the late stages of negotiations.

Despite the fact that, so far, this sounds pretty good, there are quite a few downsizes.

- Centralization (at least partial). First of all, just as Alexander Legoshin mentioned in their Telegram, “I would also say that while we do perform a partially centralized function in the cryptocurrency world, cryptocurrencies are still by their nature decentralized.” Basically, they will hold the access keys in the hardware provided by Thales (at least the keys are created there and can’t leave the module), the fiat in safeguard bank accounts, the servers will be in their full control (this could mean there is the possibility of downtime) and maybe other smaller facts. This is a clear case of a tradeoff between decentralization in the favour of convenience and usability.

The fact that Saifu is centralized to a certain extent leads to two problems, not only is the platform sensitive to downtime and other risks, but also this a pretty big hit regarding the marketing of Saifu. People in this cryptosphere seem to hate anything centralized and you never know who their next centralized target might be. - Anti Money Laundering (I am not referring to their ICO campaign).Each transaction will be checked. If a transaction is labeled as suspicious, then…explanations will be demanded and so on (keep in mind there will be an initial KYC procedure when opening the account). Officially, they will not even allow transactions of “dirty” cryptocurrencies. If you have been sold “dirty” BTC, you might get into trouble when using Saifu. Alexander also recommended using trustworthy platforms when trading, as you might become a victim of what I have just explained above. A “suspicious entity” is defined in their Whitepaper as:

• Dark Net Markets – hidden markets that sell mainly illegal items using bitcoin

• Ransomware and/or Stolen Coins – receive funds from stolen coins / known ransomware

• A mixer / tumbler - More than 80% of mixing activity is related to other suspicious entities

• A scam - Receiving funds from known scams

• An unlicensed Money Service Business - Unlicensed MSBs facilitate money laundering

• Gambling - In some jurisdictions online gambling is illegal

The reason why this is quite bad is the fact that you don’t really know if the BTC (or any cryptocurrency) in your wallet could have been in contact with a red-flagged address. And this contact with a red-flagged address might have happened years ago, who knows? All of this has not been mentioned in the Whitepaper, but in their AMA Video at 1:14:03.

- They will not support anonymous cryptocurrencies. Again, not mentioned in their Whitepaper, but in that video at 19:29. They are planning to add ERC20 and Ripple in the near future, but anonymous coins will never get on Saifu. The reason could be the fact that anonymous coins like Monero will become the target of regulations and most illegal activities are conducted by using them. Monero on Saifu would mean a bad reputation not in front of the cryptocurrency userbase, but in front of institutions and governments.

The main good aspect about Saifu is, obviously, the ability to make it easier to invest in cryptocurrencies and, thus, contribute to making them mainstream. This is where the SFU token comes into play. The SFU token will be used to offer some perks to people owning it by giving some tokens back on purchase of services and by offering discounts.

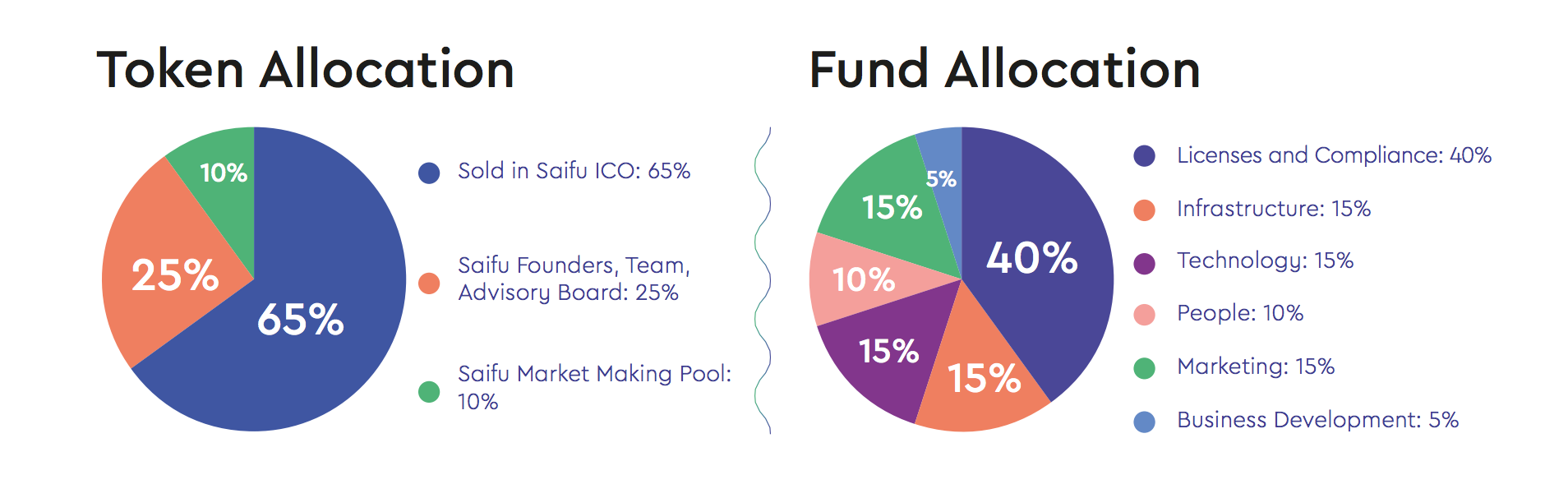

Token Details:

Saifu Tokens (SFU) are used to pay for all transaction fees on the Saifu platform. Fees are determined in at currency and paid in SFU. As Saifu targets users who seek simplicity with cryptocurrencies, customers can request Saifu purchase the tokens for them via the platform. However, using their own tokens gives customers bene ts in the loyalty scheme, which is the main function of the Saifu Token. Because all fees are paid in SFU, as demand for services increases, demand for the token should grow.

Saifu Tokens (SFU) are used to pay for all transaction fees on the Saifu platform. Fees are determined in at currency and paid in SFU. As Saifu targets users who seek simplicity with cryptocurrencies, customers can request Saifu purchase the tokens for them via the platform. However, using their own tokens gives customers bene ts in the loyalty scheme, which is the main function of the Saifu Token. Because all fees are paid in SFU, as demand for services increases, demand for the token should grow.

Ticker: SFU

Token type: ERC20

ICO Token Price: 1 SFU = 0.80 USD (0.00010 BTC)

Fundraising Goal: 49,000,000 USD

Total Tokens: 100,000,000

Available for Token Sale: 65%

Whitelist: YES

Know Your Customer (KYC): YES

Accepts: ETH, BTC, LTC, BCH, DASH, BCC, DOGE

Token type: ERC20

ICO Token Price: 1 SFU = 0.80 USD (0.00010 BTC)

Fundraising Goal: 49,000,000 USD

Total Tokens: 100,000,000

Available for Token Sale: 65%

Whitelist: YES

Know Your Customer (KYC): YES

Accepts: ETH, BTC, LTC, BCH, DASH, BCC, DOGE

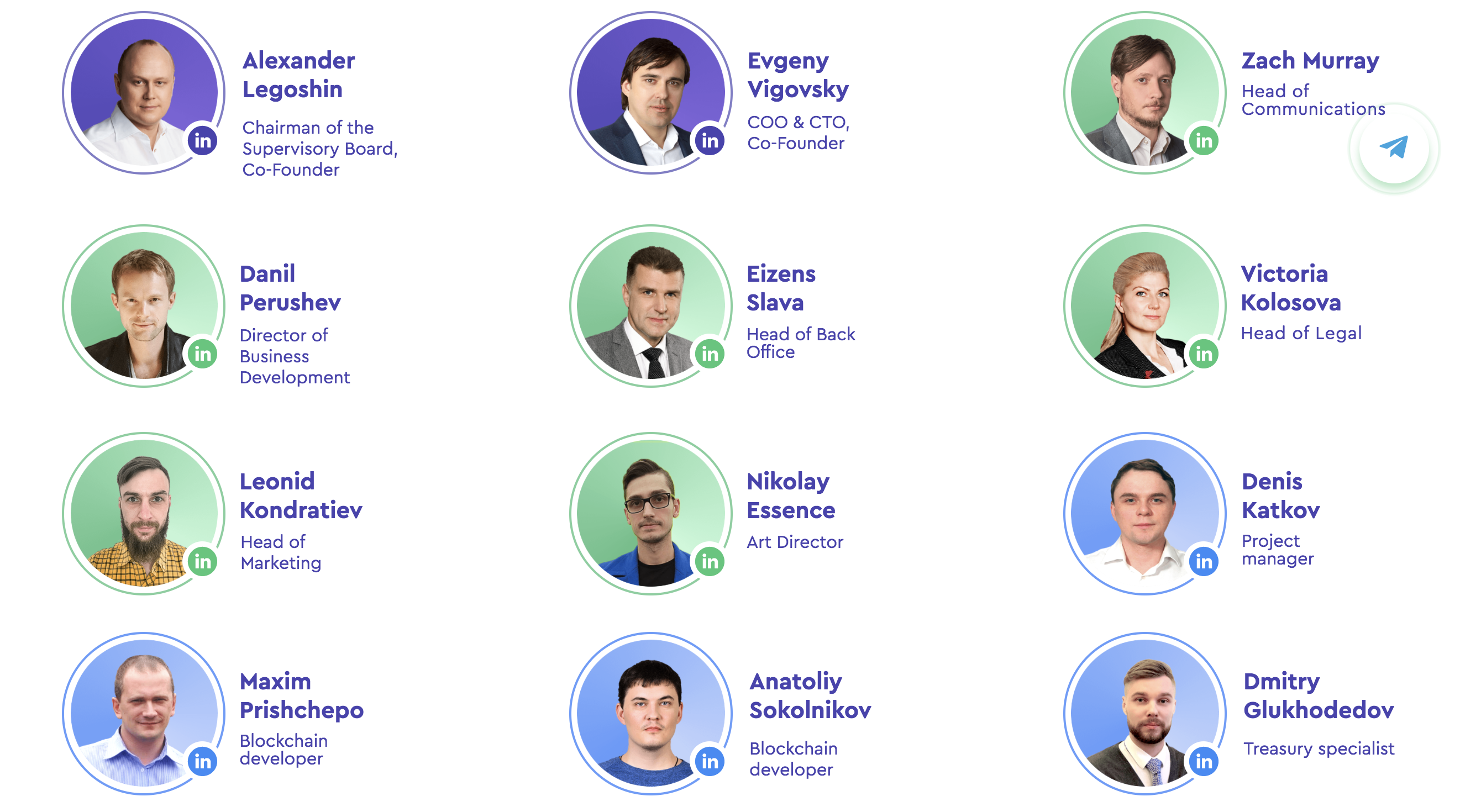

Project Team:

Important links:-

Website: https://ico.saifu.ai/

Whitepapper: https://ico.saifu.ai/Saifu-WhitePaper.pdf

Telegram Group: https://t.me/saifu_ai

Twitter: https://twitter.com/Essentia_one

Facebook: https://www.facebook.com/saifuai/

ANN thread: https://bitcointalk.org/index.php?topic=2472594.0

Whitepapper: https://ico.saifu.ai/Saifu-WhitePaper.pdf

Telegram Group: https://t.me/saifu_ai

Twitter: https://twitter.com/Essentia_one

Facebook: https://www.facebook.com/saifuai/

ANN thread: https://bitcointalk.org/index.php?topic=2472594.0

Komentar

Posting Komentar