hyperquant

What is HyperQuant?

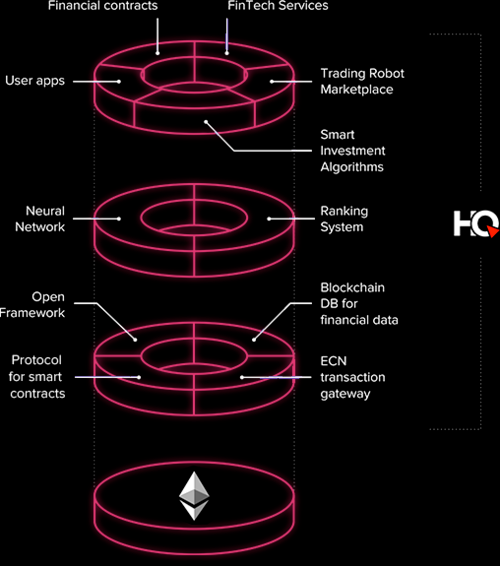

It is a decentralized platform for investments in automated encryption based on smart contracts, guaranteeing transparency in investments stimulating small investors, large investors or even capital professionals. With the advance in the technology of numbers the platform leads to an increase of liquidity in trading instruments, as well as lower volatility of trading instruments. In short, everyone will have access to a wide variety of intelligent solutions that cover all aspects of cryptographic investment and encryption processes.

Symbol and strategy:

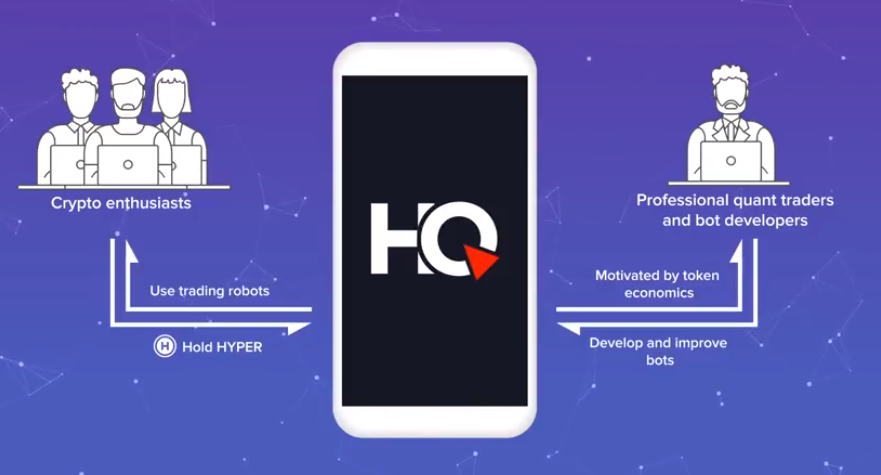

In all respects all platform participants: bot users, developers and organizations, banks and hedge funds, need to keep tokens to gain access to platform features and services. HyperQuant emits a utility token enabling the creation of an internal economy within of platform. Hence, the HyperQuant symbol (HQT) provides the opportu- nity for the useWhat is HyperQuant?

It is a decentralized platform for investments in automated encryption based on smart contracts, guaranteeing transparency in investments stimulating small investors, large investors or even capital professionals. With the advance in the technology of numbers the platform leads to an increase of liquidity in trading instruments, as well as lower volatility of trading instruments. In short, everyone will have access to a wide variety of intelligent solutions that cover all aspects of cryptographic investment and encryption processes.

How Do HyperQuant Work?

HyperQuant uses trading robots to complete trading operations on financial markets with a set of algorithms. Trading with the help of an algorithmic system has several advantages: to make decisions at maximum speed and to complete trade tasks at speeds that are not available to humans, automatically processing market data and generating trade signals, and trading signal processing accuracy allows to prevent errors by demand settings market.

Trading robots work strictly in accordance with established algorithms and complete trading operations without emotion and can manage several thousand securities simultaneously. Cryptocurrency traders and token holders are vulnerable to emotions that lead to irrational decisions. Trade strategies apply in any market, with any assets and at any time. Algorithms are carefully typed and have no risk of making the wrong decision because of uncertainty, anger, fear, and dissatisfaction. The basis of the algorithm is in the class division of strategy.

Trading strategies and models have several classifications :

- Trend Following Strategy:

The main goal of this strategy is to find favorable rates for completing trading operations with the aim of maintaining a profitable position in the longest period of time. Strategies follow the trend of trying to capture the huge fluctuations of financial instruments. A trend-based strategy based on technical indicators is the most popular strategy. Technical indicators are functions based on the values of indicators of statistical exchange, for example, prices of traded instruments. The rules of opening and closing positions in this strategy are shaped by the derivation of indicators and comparative values calculated between themselves as well as the market value. - The Counter-Trend Strategy:

is a strategy based on the expectations of significant price movements and consequent positions opening in the opposite direction. The assumption is that the price will return to its average value. The counter-trend strategy is often attractive for trading because the goal is to buy at the lowest price and sell at the highest price. - Pattern Recognition Strategy:

The purpose of this strategy is to classify objects in different categories. Image recognition tasks in distributing new, recognizable objects to specific classes. Such strategies use neural networks as the basis for education and are widely used for the recognition of candlestick patterns. The candlestick pattern is a particular combination of candlesticks. There are many candlestick models and assumptions about continuous or reverse price movements happening based on the appearance of candlestick models. These assumptions are a strategy based on the introduction of technical analysis. - Arbitrage Strategy:

There are different types of Arbitrage strategies: Cross-Market Arbitrage and Statistical Arbitrage. - Strategy based on machine learning:

The basis of machine learning is the modeling of historical data and the use of models to estimate future prices. One type of machine learning is classification.

Based on that strategy, HyperQuant created a strategy with Si Technologies Algorithm. HyperQuant's Si Technologies Algorithm Strategy is:

- Smart order execution strategy

This strategy class is based on work with orderbook. The HyperQuant software makes it possible to dynamically cite strategies depending on specific tasks.

It is not possible to execute orders at the same price first, all trades will be at the desired price, but gradually the price will become less profitable. To reduce costs, institutional clients need to use the Smart Order execution strategy. The execution of large market orders can be divided into several steps and involves a combination of strategies. Users of the HyperQuant platform will be able to configure specific fields from quotation strategies such as Instrument, Volume, Minimum volume, Maximum volume, Maximum BBO distance, Internal quotation levels, Internal quotation levels, Hedging, Hedging type and Hedging settings. - Market Making Algorithms

The execution of market-making algorithms leads to a boost of liquidity in trading instruments. This also results in lower volatility of trading instruments. Providing liquidity is essential for the development of the trading industry. The mechanism of liquidity provision is widespread in the largest stock markets such as NYSE, NASDAQ, and CME. Market makers must support two-way quotes in orderbook and adhere to some requirements The minimum quotation period and the volume of all orders are bought and sold according to market maker data. - Risk Management

Risk management is the process of adopting and meeting complex actions aimed at reducing the likelihood of unfavorable outcomes and minimizing possible losses. Every trading and investment activity poses certain risks. The risk in this case is the possibility of unexpected financial losses in an uncertain environment. Every trader faces market risk ie the possibility of changes in asset prices due to market exchange rate fluctuations. There are other risks that are rarely known to be operational, functional, selective, and liquidity risks. - Hedging

Hedging can be divided into Selling Hedge and Buying Hedge. Buying Hedge is used when traders plan to buy assets in the future and seek to reduce risks associated with price increases. Selling Hedge is used in the case of a sale in a commodity market to hedge the risk of future price falls, and implies that the seller fixes a fixed price for himself. - AI based Financial Advisor

The majority of investments fail because of incorrect risk management and inadequate control by users. To solve this problem, HyperQuant uses artificial intelligence based on data collected from HyperQuant platform users. - Blockchain based on the Smart Contract Protocol

The HyperQuant team develops an integrated protocol with standard settings for algorithmic strategy portfolios, implemented as smart contracts.

---Founder---

Pavel Pavchenko CEO |  Paul Rogov Managing Director |

|---|

---Team Members---

Dmitry Plohov Chief Operating Officer |  Alex Jadaev Senior Quant Trader |  Andrew Plotnikov Chief Risk Officer |

|---|---|---|

Olga Bystrova International lawyer |  Alex Kuklin Back-end developer |  Dmitry Nazarenko Back-end developer |

Natasha Pavlova Marketing & PR Manager |  Jc Crown Senior Business Development Manager |  Nick Popov Data Research Analyst |

---Advisor---

Elmar Malikov |  Nehemia Kramer |  Anton Shalaev |

|---|---|---|

Josef Muknšnábl |

All the important information can be found here:

WEBSITE: https://hyperquant.net/en

WHITEPAPER: https://hyperquant.net/en/whitepaper/

TWITTER: https://twitter.com/HyperQuant_net

FACEBOOK: https://www.facebook.com/hyperquant.net/

TELEGRAM: https://t.me/hyperquant

YOUTUBE: https://www.youtube.com/channel/UCOgRfmQR-GKJlbnF1tRQPgw

ANN THREAD: https://bitcointalk.org/index.php?topic=2104362.0

WHITEPAPER: https://hyperquant.net/en/whitepaper/

TWITTER: https://twitter.com/HyperQuant_net

FACEBOOK: https://www.facebook.com/hyperquant.net/

TELEGRAM: https://t.me/hyperquant

YOUTUBE: https://www.youtube.com/channel/UCOgRfmQR-GKJlbnF1tRQPgw

ANN THREAD: https://bitcointalk.org/index.php?topic=2104362.0

author : Yoloyolo

my profile : https://bitcointalk.org/index.php?action=profile;u=1832746

Komentar

Posting Komentar